need to enhance the interface, simplify the user flows, and reduce pain points in the credit application process.

― begin

Our team was tasked with reimagining Citi’s credit card acquisition and servicing processes.

~28% of Citi’s approved credit card applicants were unable to successfully complete the first step of their account registration. 22% of call center volume (of those calling in with product-related concerns) were about registration issues. On top of it, applicants had multiple product onramps across a variety of partners.

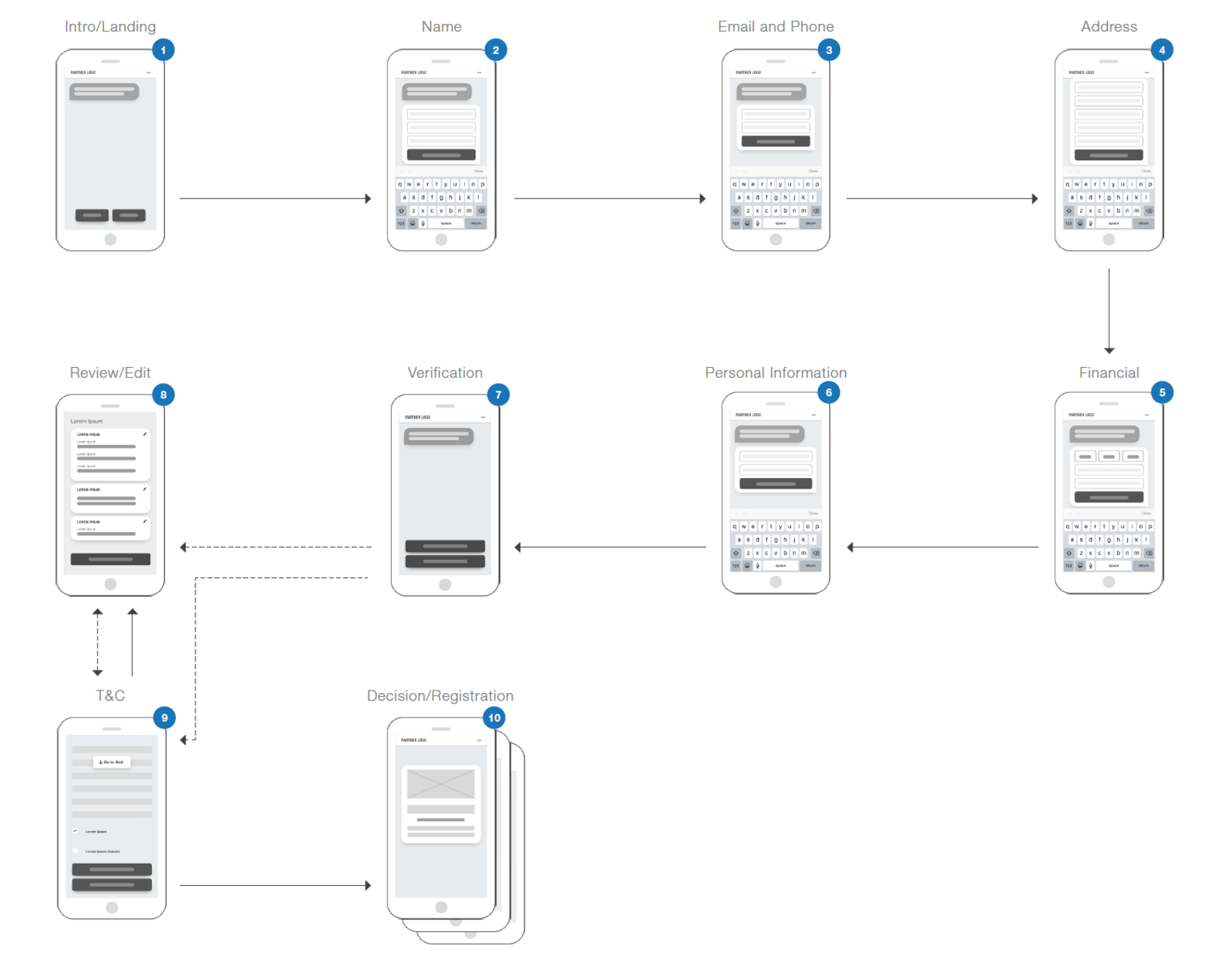

With little to no known data to inform design, I worked closely with a strategist to research and define a user journey map. I also referenced our desktop user application process to build a foundation for a new user flow for a chat-based experience.

before.

Our goal was a mobile-first experience where a user could engage in “conversation” rather than filling out a long, static form. With designing this project, we also took the opportunity to simplify current user flows and reduce pain points in the overall application process.

Our success was measured by increased acquisition and registration completion rates, increased engagement with the current product features, and decreased call volume to the client’s call center.

after.

― end

Working through tight sprints, our team streamlined user inputs, encouraged task completion, and simplified account creation with immediate account access.

Citi rolled the new feature out to three major partners and the team has taken on a fourth. Analytics show our new user flow and experience continue to increase conversion rates.